What 'DOGE, Phase II' Looks Like

A forgotten big story... What's next for Elon Musk and DOGE... The intersection of government efficiency and AI... In pursuit of 'profitable snowflakes'... Mailbag: Your thoughts on tariffs...

Remember AI?...

Remember AI?...

Tariffs have been dominating the market narrative lately (and we have a mailbag at the bottom of today's Digest full of opinions about that), but that headline story is obscuring a number of other developments that are still playing out in the market...

So today, we're sharing a recent discussion we had about the big things still happening in the world of artificial intelligence ("AI").

On this week's Stansberry Investor Hour podcast, Dan Ferris and I (Corey McLaughlin) interviewed our friend Rob Spivey, the director of research at our corporate affiliate Altimetry.

We talked about how the stock market experienced multiple significant pullbacks during the dot-com boom (which ultimately became a bubble)... and how we may be seeing the same thing happening with AI right now.

As Rob explained, that means there's opportunity amid the chaos. And, interestingly, that opportunity has to do with the intersection of AI, the White House, and Elon Musk's Department of Government Efficiency ("DOGE").

As we wrote earlier this week, Musk says he is taking a big step back from DOGE starting next month. But Rob says we're only starting to see the impact of Musk's influence and the interest of government efficiency.

What follows is an edited transcript of our conversation with Rob. You can watch the whole thing for free on our Stansberry Research YouTube page here, or listen to the entire audio version of the podcast at InvestorHour.com or wherever you get your podcasts.

Spotting the real story...

Spotting the real story...

Dan Ferris: It has been a little while. You were last on the show in December 2023. We need to catch our listeners up with you. Why don't you tell them a little about what you do?

Rob Spivey: Yeah, of course. For those who don't know us at Altimetry, we're focused on the idea that bad numbers are coming from Wall Street, bad numbers are coming from filings and everything else because of the underlying accounting behind all of it. At Altimetry, we do what we call Uniform Accounting. We clean up the accounting to get to what real economic profitability is, growth, valuations.

Then all of a sudden, Dan, we can uncover things like which companies really have a margin of safety in their business, which companies have strong profitability. Then once you get all those numbers accurate, we can start getting a better understanding of what's going on for the U.S. as a whole and the economy and the market as a whole.

Dan: So it sounds like you're doing better bottom-up analysis with Uniform Accounting, but you also imply it gives you better top-down insights as well?

Rob: Yes, when you think [about] making decisions – for instance, right now, a topical thing after all the news earlier this week on the change in tune from tariffs (that we're no longer leveraging massive ones on everyone, we're really just kind of targeting China), you step back and you think, "What's going on there?"

What we do when we get cleaned up accounting data is [look] side by side at Chinese and U.S. data and Chinese and U.S. profitability and say, "Wow, U.S. corporates are actually way more profitable than Chinese corporates. Chinese corporates are playing a volume game." And we can only do that in aggregate because we've cleaned up this data.

[But] we are not Stanley Druckenmiller. Our focus first and foremost is finding great companies and then finding great fundamental thematic stories that can help us identify those companies.

Right now, big themes that we're talking about are areas like the huge AI investment that's happening around the U.S. and around the globe and we're saying, hey, we can then use our better, cleaned up fundamental bottoms up accounting data to identify companies that we can pick off that are riding [that trend].

It's like the dot-com run-up all over again...

It's like the dot-com run-up all over again...

Corey McLaughlin: AI is still happening? I thought everything was about tariffs now...

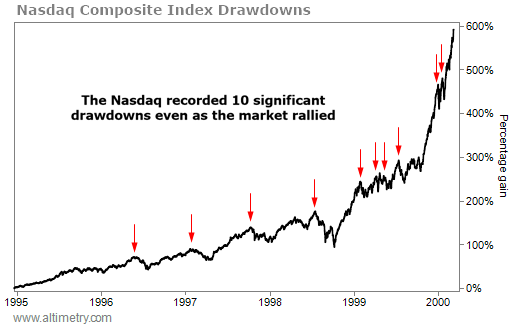

Rob: Shockingly, right? It's funny, we talk about this idea that when you look from 1994 to 2000 – look, history never repeats. History always rhymes, so, it's not ever the exact same, but if you want to look at the most recent graph that we can for something like this, in '94 to 2000, we had a huge tech adoption cycle. The Nasdaq was up 600%. Who knows where the Nasdaq or anything is going to go at the end of the AI adoption cycle, but the important thing is everybody remembers that, and we draw this magical line that goes up and to the right.

Everybody forgets there were 10 10% pullbacks in the Nasdaq from late 1994 until the 2000 bubble. Ten 10% pullbacks. There was one in 1998 that was 35% because we had a combination of, wait, ready for this – geopolitical uncertainty because we had the Asian financial crisis, we had Russia defaulting, and we had LTMC [the Long Term Capital Management blowup].

You look at all that, which sent the market crashing, but anybody who stopped and said, "Well, wait a second... Does any of this disrupt the fact that everybody wants to get on the Internet and every single thing that's happening from a technology perspective is happening there?" No. And, quite frankly, however unproductive [tariffs] are to redistribute global growth, the fact that we are in a global arms race for AI is not changing.

You really have to make sure to not take your eye off the ball, in our opinion anyway.

The intersection of DOGE and AI...

The intersection of DOGE and AI...

Dan: All right, let's go there. The topic is broached.

You guys have an upcoming presentation, and you have some serious views about AI relative to DOGE – the Department of Government Efficiency – created by Donald Trump and Elon Musk and Vivek Ramaswamy, who apparently went off to become the governor of Ohio or something.

All I see is somebody trying to cut out waste, but you see something entirely different happening. And when you told it to me a little while ago, I was like, "Oh, I never put two and two together and made four out of it as you did in this situation."

So, how do you get from DOGE trying to get rid of government excess and fraud and waste and so forth to AI? What's the connection?

Rob: That is a reasonable question, but if you step back and you look at what Elon has been doing and what DOGE's philosophy has been... it is about uncovering data. So yes... the amount that DOGE has saved has changed. The numbers have regularly [gone] up and down. But the broader thing that has been happening is [what] he has been going after, and the people working underneath him, who are really acting like junior consultants. This is what junior consultants do. They go out and they get a bunch of data and they try to create insights from it.

They're trying to gather a ton of data to be able to figure out a couple of things. One, what are the things that the U.S. government does that AI can automate? Two, what are things that the U.S. government does that AI can help actually identify how to do it more smoothly, even if it can't automate?

Elon has this five-step plan that he does every single time that he goes out and does anything. He did it at Tesla, he did it at X/Twitter, he did it at SpaceX.

First, let's question every requirement. Let's question why we're doing anything that we're doing. You saw this with USAID. You saw this with the U.S. Department of Education. Then it's delete any part of the process you can. Where he basically is saying: Let's cut deep. Let's cut sometimes even into muscle to basically make sure that we are getting to the root of what we're trying to do. Then simplify, then accelerate, which we've seen, and then last, automate.

[We've seen him] get all the data together. And now already they're starting to roll out AI tools. They rolled out this thing, GSAI [a chatbot from DOGE]. What that was all about was to basically say let's actually build a tool that can let us dump data in from the government... and then to be able to come out with conclusions. So, for instance, the U.S. Treasury... let's be able to dump data in to identify where are we seeing weird things going on with the IRS, where are we seeing weird things going on with Social Security or anything else?

What we've seen so far is really only phase one because phase one, like any good consulting engagement, having experienced a few myself, is always gather as much data as you possibly can... to get the lay of the land. Phase two is when you do the implementation, and this is what we think that we're about to see right now.

We're about to go to phase two. They've gone through all the data gathering, and some of the cost cutting is going to stick around. Some of the cost cutting may go up or down, but the real story is going to be how they unleash AI in the government. And that's going to be the real way that they can save money and make the government more efficient.

The Turing Institute said that more than 80% of U.S. government tasks, global government tasks, are mundane, process-driven data-entry. All that stuff is what AI can do. And so our point, which we think is really interesting, Dan, is this is the kind of environment where what Elon and what DOGE is kicking off is going to be transformational for years to come in terms of the U.S. government, but also in terms of how it's moving the Overton window [a spectrum of ideas on public policy and social issues that are considered "acceptable" by the general public at a given time] for the whole entire U.S. economy – on what it's OK for us to use AI for or not.

And so that's the big story that we think is coming now. When you get past the noise of tariffs, this is what the real big story – if we look at a year from now – is going to be.

Dan: OK, so let's face it, it's desperately needed. Something has to change with $36 trillion in debt and growing and massive deficits, etc. My question for you, Rob, is there any reasonable expectation of the government using AI for all that untouchable stuff like Social Security? Medicare, what could it do there?

Rob: I love the question. I'm going to start with health care... There are all these things like in terms of how we approve and deny treatments, how we think about what the right process is... and making sure that we have the right health care steps being followed. AI being on top of that and making sure that those things are happening can speed up your cycle times from a health care perspective [the time a patient spends at a facility] and also can reduce waste. It's not about actually cutting services. There are a lot of ways in health care we can actually save costs without reducing treatment. And then you get into everything else in terms of defense and the broader things.

Finding the opportunity...

Finding the opportunity...

Corey: I think we could all agree on the government efficiency point. I'm wondering how AI translates into profitability for companies and margins. How do you look at these major themes and what AI can do and try to find a company or companies or sector that actually gets the most out of the opportunity?

Rob: The first thing you have to do is chart out the whole entire ecosystem to understand where the players are. And we spent a lot of time in 2023 and early 2024 doing this – what we call the AI "blast zone" or ecosystem. You have the hyperscalers, Nvidia, Meta, the Amazons, the Microsofts. And then one step from that, you have the people who are helping build out AI, your data centers, data-center suppliers. But what's really interesting is when you get to the users.

These are the people who are taking AI and using AI to either turn it into a product to sell to somebody or also using it to improve their own business, or ideally, doing both. Then you have the enablers. These are the people who, if you want to use AI, you're going to have to lean on – not from a hardware perspective – but they're the ones who are going to help you figure out how to do this. This is consultants. This is cybersecurity solutions. This is some level of cloud computing, outside of the hyperscalers, and then you have the people who are going to make the equipment for those people and then the commodities [involved].

We're seeing really interesting companies. Twilio (TWLO) is a company that basically makes the software and the solutions to run your call center, to do anything that you need to do with your customers. What Twilio sits on because of that is a mine of data and a mine of process understanding because they've been doing this for 10-plus years. The guy who built Twilio left from [Amazon Web Services] AWS after he helped stand up AWS, and then he stood up this business. And what they're doing now is leveraging AI... If you're in a call center, literally the AI side by side with you will listen to the conversation that you're having with a customer and [bring] up the last time a customer asked this question [and]... point them toward [a solution].

The other thing that they're training the AI to do is to be the first inbound when somebody calls. The AI answers, and it actually sounds like a person as opposed to a "please hold and press one, or two, or three," or "please tell me in one or two words what you need." It's not that anymore. Those kinds of things. Think about how much of the U.S. government, health care specifically, but so much U.S. government is effectively customer service. And so companies like Twilio are a great example of how we're seeing AI enablement. Companies with that long-lasting value creation, that have high return on assets, durable, remote businesses... are the kind of companies that we at Altimetry love to own.

I'll give you another example... This isn't a recommendation, because this company is not profitable, but it's an example of a company that helps warehouse and keep your data in an organized way so you can leverage AI. This is Snowflake (SNOW). Snowflake lets you create a world where your data is organized, which everybody is going to need. And there's a bunch of other companies that we've identified that we're really excited about. I'm not going to tell you all of them, Dan, because some of them we're holding back for our subscribers... they're like Snowflake but profitable. Profitable Snowflakes.

Dan: That's a good description.

Rob: Really good high return on assets businesses. The things that Dan, because you and I talk about this all the time in terms of economic moats and return on assets, actually are making money because that's what matters to us. Not just the story. The story can only get you so far.

Editor's note: As we mentioned earlier, you can watch our full conversation with Rob at our Stansberry Research YouTube page. And to learn how you can access the exclusive stock recommendations Rob is talking about, check out his brand-new presentation on "DOGE: Phase II" right here.

You'll get all the details on Rob's updated thesis on Musk and Trump's next move regarding DOGE – specifically, how it could trigger a massive stock market move beginning May 1.

Rob also introduced a special guest live on camera – his most valuable contact in Washington – to help pull back the curtain on what's happening with what he says will be the dominant market story for the rest of the year.

New 52-week highs (as of 4/24/25): Alpha Architect 1-3 Month Box Fund (BOXX), FirstCash (FCFS), K+S (KPLUY), Lonza (LZAGY), Sandstorm Gold (SAND), and W.R. Berkley (WRB).

New 52-week highs (as of 4/24/25): Alpha Architect 1-3 Month Box Fund (BOXX), FirstCash (FCFS), K+S (KPLUY), Lonza (LZAGY), Sandstorm Gold (SAND), and W.R. Berkley (WRB).

In today's mailbag, your thoughts on tariffs (and inflation)... Do you have a comment or question? As always, e-mail us at feedback@stansberryresearch.com.

In today's mailbag, your thoughts on tariffs (and inflation)... Do you have a comment or question? As always, e-mail us at feedback@stansberryresearch.com.

"Your newsletter information about 'panic buying' and 'pulling sales forward' rings true. Business and residential package volumes at FedEx, where I work, have been absolutely crazy the past month – particularly the past two weeks. [It] is every bit as busy as Christmas rush. I recently commented to a colleague that I wonder what is going to happen after forward purchases are made and tariffs take effect. My thinking is business will drop off a cliff. We will be lucky to work 20-30 hours per week." – Subscriber L.S.

"Your newsletter information about 'panic buying' and 'pulling sales forward' rings true. Business and residential package volumes at FedEx, where I work, have been absolutely crazy the past month – particularly the past two weeks. [It] is every bit as busy as Christmas rush. I recently commented to a colleague that I wonder what is going to happen after forward purchases are made and tariffs take effect. My thinking is business will drop off a cliff. We will be lucky to work 20-30 hours per week." – Subscriber L.S.

"Your analysis of tariffs and imported automobiles is one thing to drive up the cost of vehicles. Another is the tariff on raw material that go into the domestic vehicles. The 25% tariff place on steel and aluminum will also drive up the costs of the autos and those tariffs have been the first to take effect and have not lifted. I haven't heard anything about Pres. Trump lifting them but then again, he wants to economically cripple Canada so we will willingly join the USA. Since a lot of the raw materials you use are sourced from elsewhere good luck having any goods manufactured with them to go down anytime soon." – Subscriber Marnie J. (Proud Canadian)

"Your analysis of tariffs and imported automobiles is one thing to drive up the cost of vehicles. Another is the tariff on raw material that go into the domestic vehicles. The 25% tariff place on steel and aluminum will also drive up the costs of the autos and those tariffs have been the first to take effect and have not lifted. I haven't heard anything about Pres. Trump lifting them but then again, he wants to economically cripple Canada so we will willingly join the USA. Since a lot of the raw materials you use are sourced from elsewhere good luck having any goods manufactured with them to go down anytime soon." – Subscriber Marnie J. (Proud Canadian)

"Personally I think EVERYONE is overreacting to the tariffs.

"Personally I think EVERYONE is overreacting to the tariffs.

"Trump doesn't want costs to rise for the US consumers. He's using tariffs as a negotiating tactic so the import/export field of doing business is level.

"Since the end of WWII other countries have been taking advantage of the US market. We happen to be the largest economy for the entire world. We should be controlling markets not be controlled.

"Unfortunately, no other president before Donald Trump has even attempted anything this drastic and aggressive to level the playing field. This was long overdue to be done. Nobody else had the nerve to do anything. It's time we have a fair shot at our goods getting into other countries' markets..." – Subscriber Marc D.

"Anecdotally, I went to Costco for a bi-monthly trip to load up on the essentials. I couldn't believe the price increases from just earlier this year. If there isn't a red-hot [consumer price index] number showing up in May (for April figures), then whoever is 'counting' the changes in price each month has to be massaging those numbers!" – Subscriber Beau E.

"Anecdotally, I went to Costco for a bi-monthly trip to load up on the essentials. I couldn't believe the price increases from just earlier this year. If there isn't a red-hot [consumer price index] number showing up in May (for April figures), then whoever is 'counting' the changes in price each month has to be massaging those numbers!" – Subscriber Beau E.

Good investing,

Dan Ferris and Corey McLaughlin

Medford, Oregon and Baltimore, Maryland

April 25, 2025