The Answers to the Tariff Test Are Coming

We all want to know what effects tariffs will have on our favorite businesses.

We also want to know whether or not we should worry about a recession.

To find the answers to these economic uncertainties, we simply need to be patient... because the market is about to tell us during this earnings season.

While there's no official kickoff date to earnings season, many believe it started on April 11 when banking giants Wells Fargo (WFC) and JPMorgan Chase (JPM) reported their numbers.

As more public companies report their latest quarterly results throughout the next week and into May, we'll get some extremely valuable information on what's coming next.

That's because President Donald Trump made plenty of noise regarding his plans for U.S. trading partners last quarter – long before he officially announced his new "Liberation Day" tariff policies on April 2. So by analyzing earnings data and recent statements from executives, we can better understand what moves companies are making in response to these changes.

I (Jeff Havenstein) will start with a business that I love... Snap-on (SNA).

Snap-on is the leader in the professional-tool industry. The company designs and sells tools, equipment, and diagnostic and information systems. It primarily does business with auto mechanics, but it also targets aerospace, agriculture, construction, and defense customers. (You'll likely recognize Snap-on from its white and red vans.)

Over the long term, there are strong tailwinds behind Snap-on's business... Demand for repair tools is expected to grow, thanks to an aging car population and rising vehicle complexity. The company is also "capital efficient" and a strong dividend payer (it hasn't reduced its dividend since 1939).

Snap-on reported its most recent quarterly results last Thursday. And, well... the market didn't like what it heard.

Revenue and earnings both came in below expectations.

The problem wasn't with Snap-on's manufacturing, as the company mostly manufactures products locally for U.S. customers and won't be greatly impacted by tariffs. Rather, the problem was with its customers...

Uncertainty around tariffs has made repair technicians more hesitant to purchase big-ticket items that they typically finance through Snap-on.

Said another way, Snap-on's customer base is taking a cautious, wait-and-see approach to tariffs. And that's what has hurt Snap-on's results over the past few months.

Because of these disappointing earnings, Snap-on shares fell 8% in a single day.

It's my opinion that we'll see plenty of similar earnings reports in the months to come – where results suffer because either management or consumers are playing it safe.

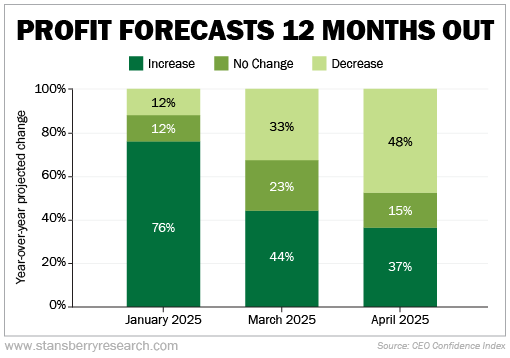

This is supported by the most recent results from the CEO Confidence Index...

CEOs participating in this survey were asked, "What changes do you forecast for your firm's profitability over the next 12 months, compared to the previous 12 months?"

Clearly, CEOs today are pessimistic about profits...

A whopping 48% of them expect profits to fall – which is up 15 percentage points from just one month prior.

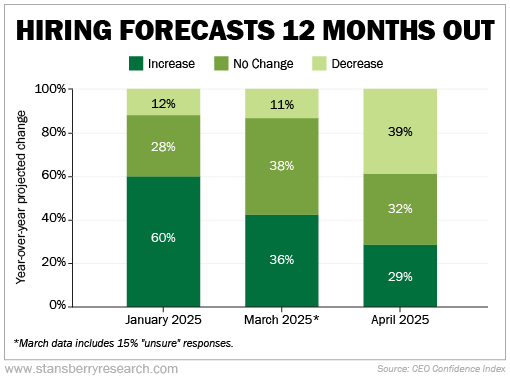

And the pessimism doesn't end there. CEOs were also asked, "What changes do you forecast for your firm's headcount over the next 12 months, compared to the previous 12 months?"

As you can see, CEOs had a bleak outlook for hiring, too...

Forecasts for hiring decreases soared to 39%, a huge jump from the 11% reading in March.

Put it all together, and it's clear that business leaders are lowering their expectations because of tariff policies. I think this will cause a lot of market volatility over the next several weeks.

Plus, in just about a half hour or so, we'll get earnings reports from technology company International Business Machines (IBM), staffing company Robert Half (RHI), and chipmaker Texas Instruments (TXN). All of these will give us further insight into how businesses are faring.

And by the end of earnings season, we'll undoubtedly have a better sense of the broad impact of tariffs on companies and whether we could be headed for a recession. But in the meantime, be sure to follow your stop losses in case we do see high levels of volatility, as I expect.

Lastly, before I sign off today, I want to alert you to something that could have a massive impact on your portfolio...

While most investors and members of the mainstream media are preoccupied with the tariff drama, Trump and Elon Musk have been quietly working behind the scenes to launch Phase II of their cost-cutting measures.

According to Rob Spivey at our corporate affiliate Altimetry, this "radical next chapter of Elon's master plan" could have dramatic consequences for the stock market as early as May 1. Rob will cover all the details – as well as how you can take advantage before this saga unfolds – in a free presentation tomorrow at 8 p.m. Eastern time. Click here to reserve your spot now

What We're Reading...

- Something different: Pope Francis has died, the Vatican says.

Here's to our health, wealth, and a great retirement,

Jeff Havenstein

April 23, 2025